report

The French scallop market: Products and performances

The French scallop market: Products and performances

author

Marketing Seafood

published

Nov. 12, 2015

The French scallop market: Products and performances

author

Marketing Seafood

published

Nov. 12, 2015

Discounts are available for multiple report purchases. Contact us for details.

For more information: reports@undercurrentnews.com

The French scallop market: Products and performances

author

Marketing Seafood

published

Nov. 12, 2015

An invaluable tool for all scallop players

Designed to give producers, exporters, traders and processors a clear and precise picture of today's French retail market for scallop and scallop-based products

With over 130,000 metric tons of scallops consumed in 2014, France has retained its undisputed position as Europe's largest market for this delicate seafood, despite a weakened demand. In this 54-page-long report -- an update on the 2011 edition -- seafood marketing expert Marie Christine Monfort takes an in-depth look at the French retail market for scallop and reveals its dynamics and potential. The core of the report is based on a large scale storecheck of 200 products across all major French supermarkets (provided alongside the report in an excel database upon purchasing).

With over 130,000 metric tons of scallops consumed in 2014, France has retained its undisputed position as Europe's largest market for this delicate seafood, despite a weakened demand. In this 54-page-long report -- an update on the 2011 edition -- seafood marketing expert Marie Christine Monfort takes an in-depth look at the French retail market for scallop and reveals its dynamics and potential. The core of the report is based on a large scale storecheck of 200 products across all major French supermarkets (provided alongside the report in an excel database upon purchasing).

Mature market adapts to dwindling demand

The French are among world’s largest consumers of scallop, with over 2 kg whole weight equivalent consumed per annum per capita. Yet demand has dwindled. France's total retail market for scallop based products was estimated at €230 - €250 million in 2014, showing a decline from the peak year of 2009, which stood at €280-300m. The report shows how this mature market is adapting to the shrinking purchasing power of the French consumer.

The storecheck: VAP, packaging developments

Stores of the following retail chains were visited in the period from May to October 2015 to construct this report:

- Aldi

- Auchan

- Carrefour

- Casino

- Grand Frais

- Intermarche

- Leader price

- Leclerc

- Lidl

- Picard

- Systeme U

The checks found that while the supply of shucked meat, chilled and frozen has dropped compared to 2011, interesting developments have emerged on the segment of value added products, with new recipes, new packaging.

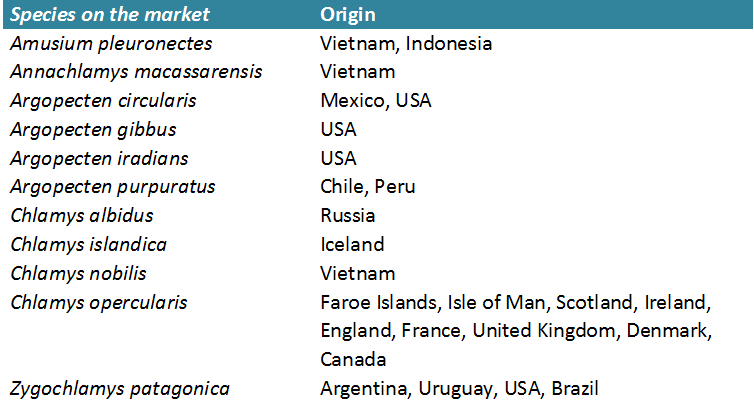

New species join the mix

France is open to all pecten species. The 2015 report found the presence of four species that were not reported in our 2011 edition. These were:

- Amusium pleuronectes from Vietnam or Indonesia

- V Argopecten gibbus (United States)

- Chlamys albidus (Russia)

- Annachlamys macassarensis (Vietnam)

The below table shows all the species observed in the market this year.

A diversified processing landscape

While the demand for shucked meat, chilled or frozen has shown signs of decline, the supply of value added products, incorporating scallop meat from less than 10% to more than 80%, has increased. These products are processed by small to medium scale companies with highly diverse profiles. Some are scallop specialists; others deal with seafood in general, while a few, the largest ones, are multi proteins generalists. Out of the 22 companies identified, all are based in France and all process scallop from imported origin. Their names are provided in the report. Get all the raw data The report comes in the form of a PDF available immediately upon purchase. An additional EXCEL file with full details of the 200 items observed across the stores is available on demand at no extra cost, just email us at marketing-seafood@undercurrentnews.com after purchasing the report.

Table of contents

About the author

Marie-Christine Monfort is a senior market analyst specialized in seafood markets and products, with 25 years’ experience observing and analyzing the French market.